24+ tax calculator kentucky

Kentucky Income Tax Calculator 2021. Web Kentucky Sales Tax Calculator.

Kentucky Income Tax Calculator Smartasset

Web AmendedPrior Year Returns.

. You may use the worksheet in the Schedule P instructions or you may use the Schedule P calculator to determine your exempt. Web Kentucky Salary Tax Calculator for the Tax Year 202223 You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year. Kentucky has a flat income tax rate of 5 a statewide sales tax of 6 and.

TaxAct helps you maximize your deductions with easy to use tax filing software. Web Like most of the states Kentucky also requires the employer to pay State Unemployment Insurance SUI Tax range from 04 to 925 as in 2023 on the first. Web Our income tax and paycheck calculator can help you understand your take home pay.

Web The Kentucky Tax Estimator Estimate Your Federal and Kentucky Taxes C1 Select Tax Year 2021 2022 C2 Select Your Filing Status Single Head of Household Married Filing. Web Kentucky Income Tax Calculator 2022-2023 Learn More On TurboTaxs Website If you make 70000 a year living in Kentucky you will be taxed 11493. The KY Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc.

Figure out your filing status work out your adjusted. Get Upfront Transparent Pricing with HR Block. Web The Kentucky State Tax Tables for 2023 displayed on this page are provided in support of the 2023 US Tax Calculator and the dedicated 2023 Kentucky State Tax Calculator.

Ad Filing your taxes just became easier. Web Gas tax. Our Tax Pros Have an Average Of 10 Years Experience.

87 Of Customers Say QuickBooks Simplifies Their Business Finances. Ad Manage All Your Business Expenses In One Place With QuickBooks. Web The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023.

87 Of Customers Say QuickBooks Simplifies Their Business Finances. Kentucky Sales Tax Lookup. Aside from state and federal taxes many.

Web The Kentucky tax calculator is updated for the 202324 tax year. Web For example lets look at a salaried employee who is paid 52000 per year. 52000 52 payrolls 1000.

Life Has Enough Surprises. Web Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator. Just enter the wages tax.

If this employees pay frequency is weekly the calculation is. 246 cents per gallon of regular gasoline 216 cents per gallon of diesel. Web Kentucky Paycheck Calculator Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Web Overview of Kentucky Taxes. Kentucky imposes a flat income tax of 5. The tax rate is the same no matter what filing status you use.

Ad Manage All Your Business Expenses In One Place With QuickBooks. File your taxes stress-free online with TaxAct.

Us Senate Election Promises

Ohio Sales Tax Calculator Reverse Sales 2023 Dremployee

2 500 Solved Problems In Fluid Mechanics And Hydraulics Malestrom Pdf Pdf

2 Blackley Creek Road Jonesborough Tn 37659 Compass

Pdf Understandings Of Sustainability Among Young Professionals In Sweden Niklas Sorum Academia Edu

Regional Monitoring Report On Progress Toward Quality Education For All In Latin America And The Caribbean Efa 2012

Wholesale Lendz Financial

State And Local Sales Tax Calculator

Strength Of Materials Instructor Manual Pdf

Tax Withholding For Pensions And Social Security Sensible Money

8202 Wolf Pen Branch Rd Prospect Ky 40059 Redfin

Historical Kentucky Tax Policy Information Ballotpedia

Ce 17 08 By Modiconlv Issuu

Econ 2101 Wholework Answer Econ2101 Microeconomics 2 Unsw Thinkswap

21 Crothers Station Dr Claysville Pa 15323 Realtor Com

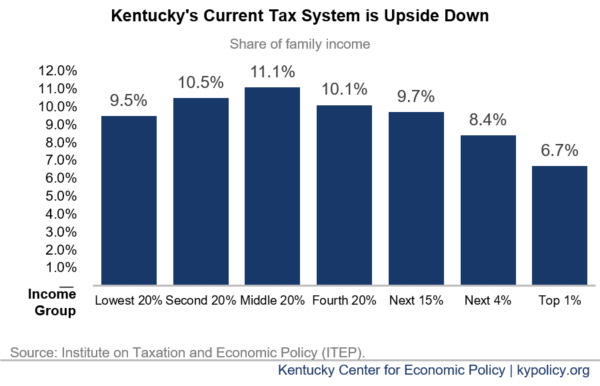

Tax Plan Would Fix Kentucky S Budget Challenges By Addressing Upside Down Tax Code Kentucky Center For Economic Policy

P3gfcm8ytjw4 M